An American Psychological Association’s “Stress In America” survey found that 72% of adults reported feeling stressed about money “at least some of the time” (financial stress survey). Money topped work, family responsibilities, and health concerns as the top source of stress. According to another survey of more than 1,000 adults, money was cited as the second leading cause of divorce, behind infidelity (financial stress in relationships). While the US is the richest large country in the world per capita, many Americans suffer from a lack of financial peace—as do people all around the world. Stress shortens both the quality and quantity of life. According to WebMD, stress “seems to worsen or increase the risk of conditions like obesity, heart disease, Alzheimer’s disease, diabetes, depression, gastrointestinal problems, and asthma” (stress and physical health). While money is not an end itself, it factors heavily in the life satisfaction equation as a means to live, fulfill responsibilities, and achieve goals.

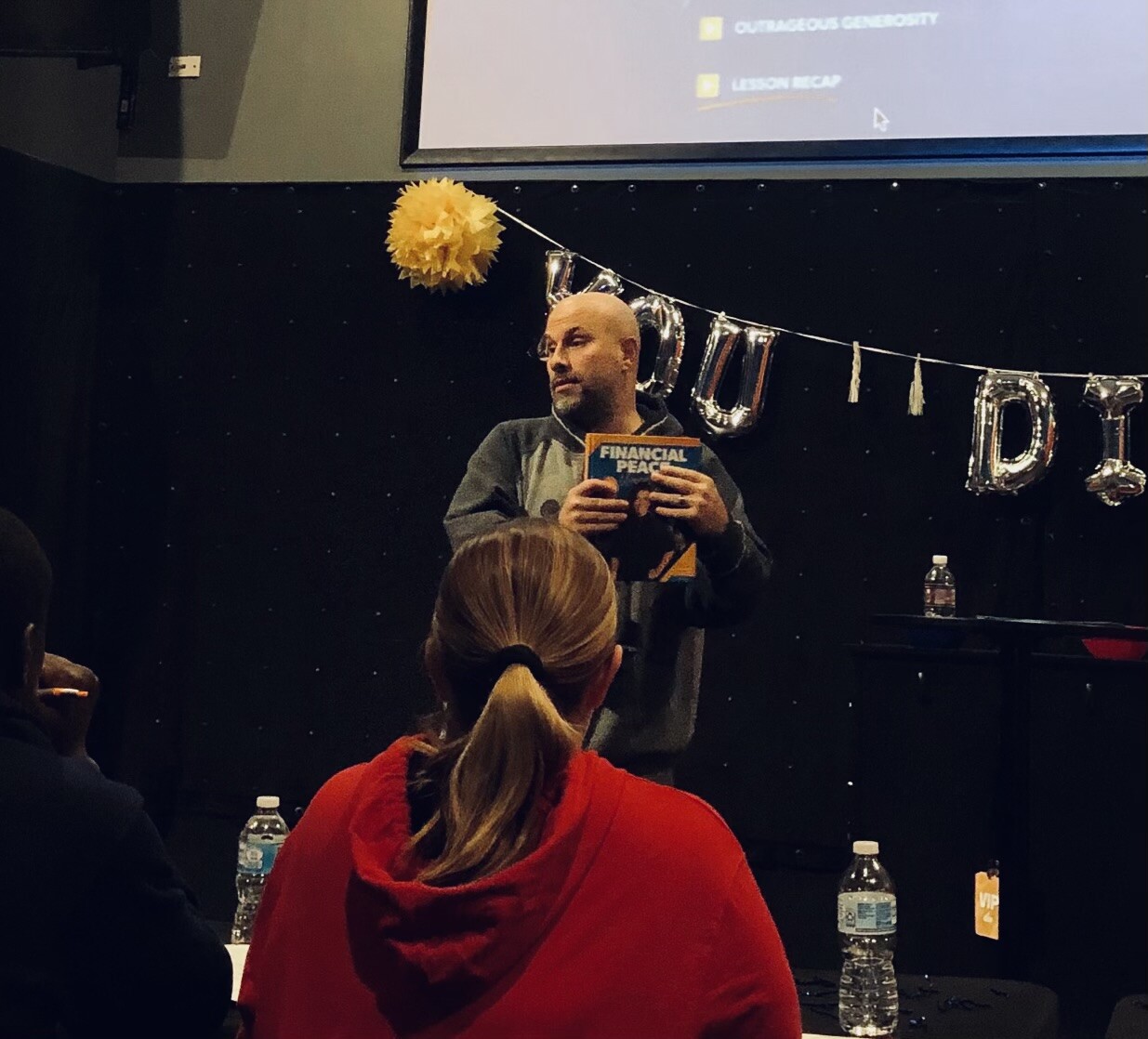

This week, I reached out to my uncle, Yousef Zananiri, to share some of his wisdom on money management. Mr. Yousef is a Strategic Sales Manager for a team at Spectrum Enterprise responsible for ~$25-$30 million in annualized revenue. His team sells scalable fiber technology and communication solutions to the government and educational sectors. In the evenings, Mr. Yousef volunteers teaching “Financial Peace” at C3 Church in Canal Winchester, Ohio—a class inspired by the philosophy of Dave Ramsey—to help people get out of debt and lock up their financial future. The following is an account of a live 60-minute interview conducted in person. You can find Mr. Yousef on Instagram @yzananiri

[For more, see the complete archive of interviews.]

Tell the people a little about yourself.

I moved to the US from Jordan 32 years ago at the age of 13. I finished my high school at a private school here in Columbus and graduated college from Fisher at Thee Ohio State University with a degree in business. About 80% of my work experience has been in the telecommunications industry and about 20% in the financial sector—45% in management and 55% as an individual contributor.

Outside of work, I’ve been married to Heather for 20+ years. We have three kids—a first year college student, a junior in high school, and an 8th grader in middle school. I’ve coached 6 different sports spanning over two decades, including lacrosse, basketball, and adult softball. I enjoy following sports and the stock market and watching how companies are trending.

What is “financial peace,” both as a concept and in terms of the class you teach?

Financial peace is to be in control of your money versus your money being in control of you. People work too hard in this country not to be able to enhance and expand their capabilities by learning some basic concepts. Financial peace comes from living within your means, paying off debt, and preparing for the future. It also comes from contentment and being generous toward others.

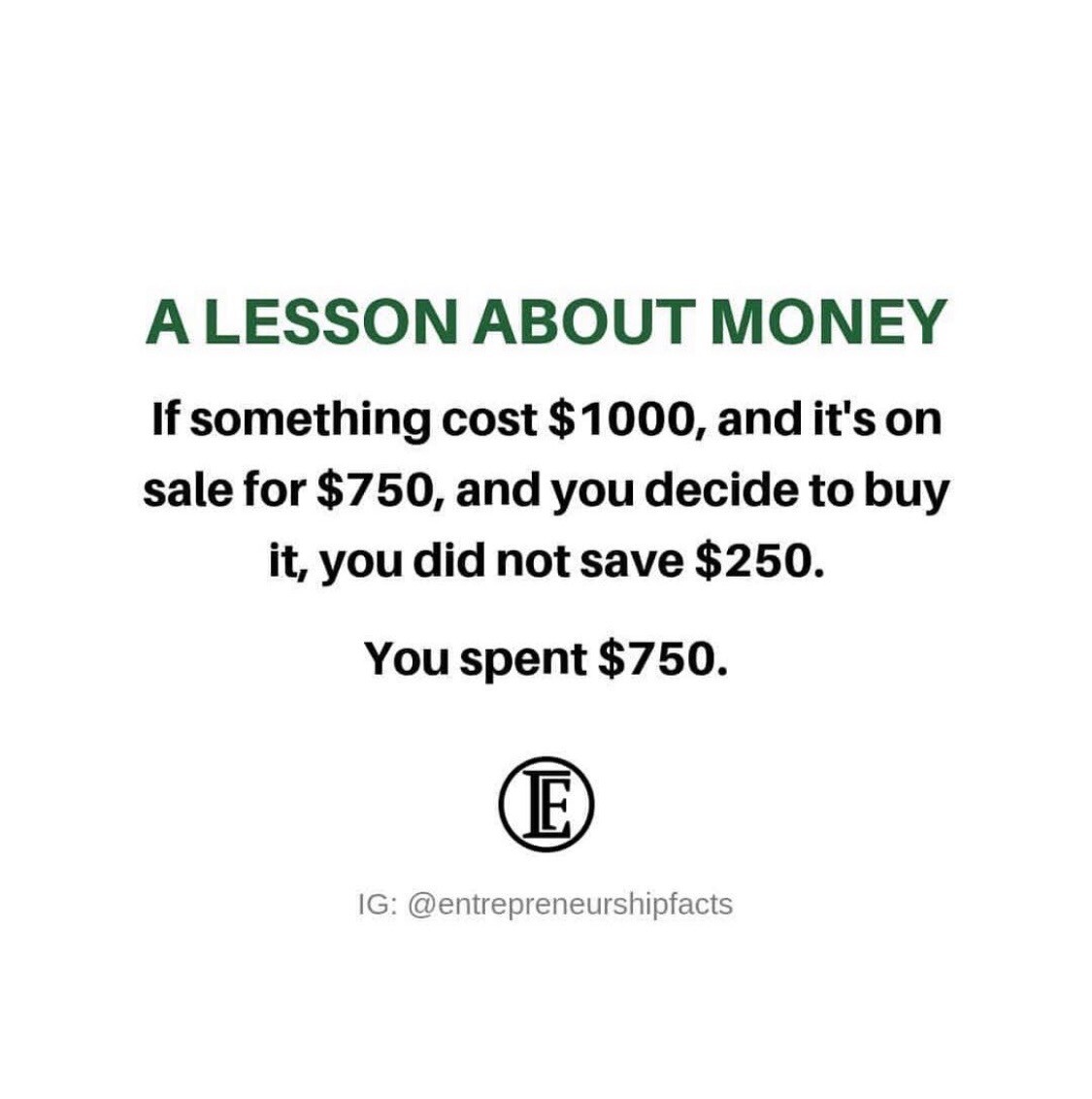

The focus of the class I teach is behavioral/psychological. The idea is that by changing the decisions we make, independent of anything external, we can achieve goals we never thought possible. The class gives you a framework to handle all aspects of finance, from learning how to play offense and defense with your money. In the course, we also teach contentment—not wasting money on impulse buying or to keep up with the Joneses.

To sum it up, we inspire and empower people to make smart financial choices that benefit themselves and the people they care about.

What are the biggest things that trip people up financially?

If I had to summarize the top 3, in no particular order, the first piece is a lack of awareness—whether that’s not having the education or knowledge to manage or maximize your money.

The second piece is lack of a framework/gameplan. Ultimately, everybody has goals they want to achieve, but not everyone has a plan in place to get there. A lot of people just go through the motions. It’s like a football team hoping to win a game without having practiced a single time.

The third piece is lack of contentment. Social media plays a big role in creating a constant demand to buy things people don’t need. This is the reason why a lot of people hesitate to take the class and make lifestyle changes—because they haven’t dealt with the psychological side of things.

What are the overarching goals of the program?

The ultimate goal is to spend less than you make, to set aside money for the future, and to not be hampered by financial stress—to obtain financial freedom, in other words. On the flip side, financial freedom enables you to be generous toward others. There is a term we like to use for it, and that term is “outrageous generosity.” When you’re no longer worried about your own financial situation in your own home, you can shift your focus to the people around you. Giving to needy people on a consistent basis, we believe—through churches, charities, communities, or specific causes—is what brings the ultimate satisfaction in life. This stage is the final stage of the process that you want to reach.

How to you pitch people to enroll?

This curriculum has been around for three decades. Millions of people have followed this plan and have achieved the outcomes they were looking for. Of the 100+ people who have completed my course, we have many examples of people we have helped get out of debt, people who have been able to save more money, build up their emergency fund, start investing for the future; and, in some cases, start on a path to pay off their mortgage early. Above all, they are now able to give more than they were able to in the past. People’s lives are better. They’re happier. I know this because they told me.

If you’re struggling, then you have nothing to lose. If you think you’re doing OK, then you could be doing even better by learning these concepts. If someone has not gone through a course like this before, it is highly recommended they do so at least once in their lifetime.

What are key elements of financial stability?

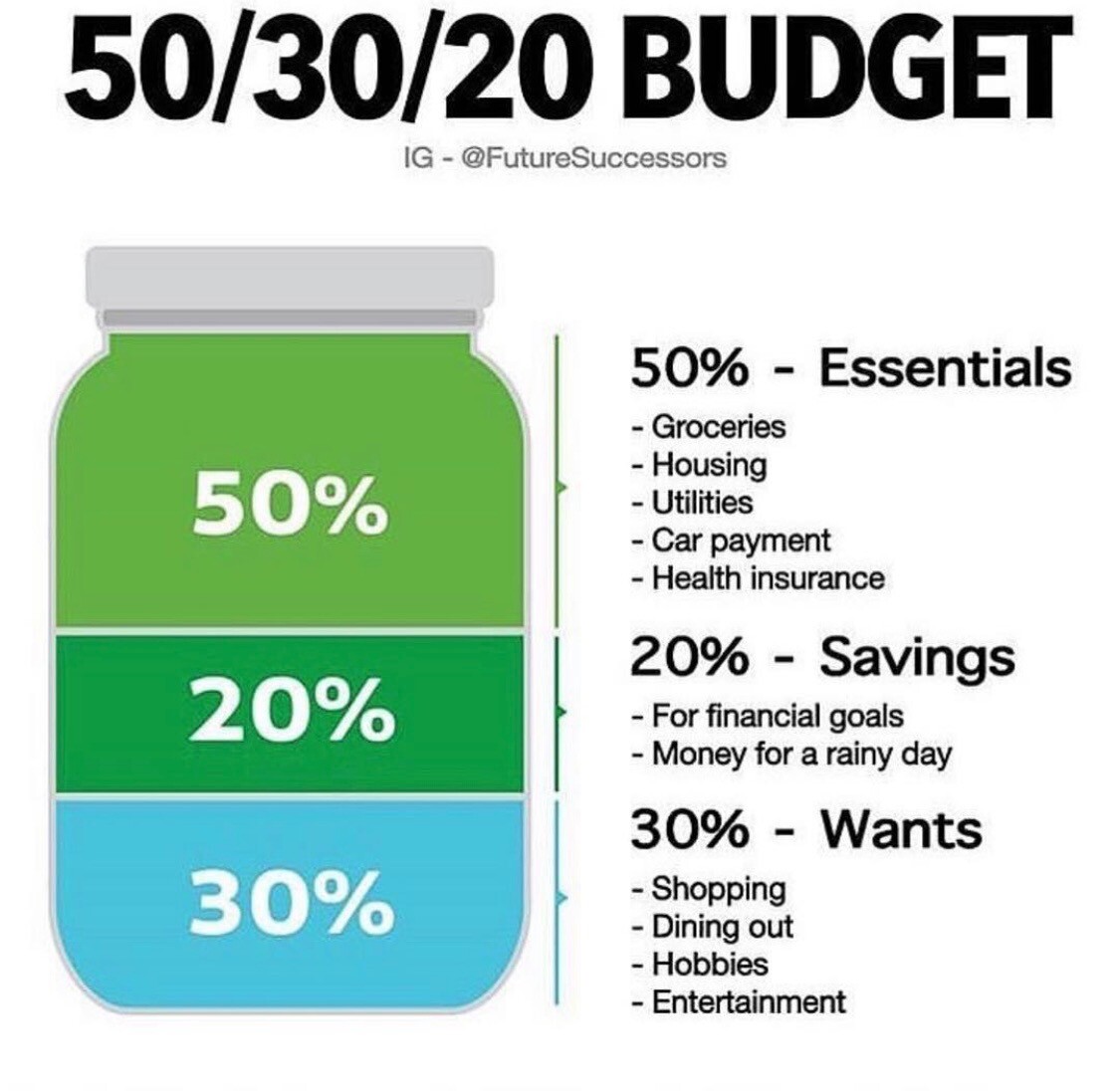

Maximizing your income in the field that you’re in is the number one wealth-building tool. Another thing is reducing spending to less than what you bring in. There’s paying off debt—not relying on high-interest credit cards or loans that limit your freedom. We advise setting aside an emergency fund with 3-6 months of living expenses, just in case you lose your job, go through a health crisis, or some other unpredictable event. Obtaining quality insurance—home, car, health, etc.–is also important. Once you have those basic things in place, you can start investing for the future–including retirement, a 529 college plan for your kids, or an individual investment account–and pay off your mortgage on an accelerated schedule.

The steps really do matter, and you don’t want to go out of sequence. For example, we eliminate all debt minus the mortgage before we set aside an emergency fund and before we invest. We start with the smallest debt and then we snowball to the next one. As I said, our approach is behavioral/psychological. We don’t make it 100% about math. The curriculum contains a lot of data, but 80% of our focus is on controlling the human element.

What are some tips or principles that you teach your students?

Budgeting is one of the biggest things, because budgeting is all about awareness. The details of a lot of people’s spending habits are out of sight and out of mind. On the other hand, when people plan for every dollar that comes in, they make better decisions. We say, “Every dollar has a name.” For example, if I know that I’m spending exactly $600 a month eating out, I can ask myself, is it adding that much value? Is it worth me working three days for it? And then I can compare/contrast that value with the value of other activities. We use the “Every Dollar” app. I’ve used different ones over the years. This is by far the best one.

There are formulas that we recommend for asset allocation and debt repayment. In some cases, we discuss strategies to increase income, whether that’s taking a seasonal or part-time job, in order to expedite the process.

The financial future of many people in committed relationships is not solely dictated by their decisions. Can you talk about the relational piece of finances?

There are “free spirits,” and there are “nerds,” as we like to call them. People who are more liberal in their spending habits and people who are more tight-fisted. It starts by recognizing what you and your partner are and coming together to create a plan. For example, maybe someone who has nerd tendencies can put together the budget, but they allow room for someone who’s a free spirit to make changes. The budget is less about specific categories and more about the bottom line not exceeding income. There’s room to negotiate.

We’re not matchmakers. We don’t get into who you should be with, but we have some rules and best practices provided for managing finances in a relationship. Overall, a willingness to communicate is the biggest thing. If you have that, you can make a lot of progress.

We also believe that accountability is very important for everyone. If you’re single, you need to find an accountability partner that can support you in this process.

What motivates you to volunteer to help other achieve their financial goals?

I think I’ve always enjoyed financial concepts and developing people. This course combines both of those things really well. I am a big believer in the concept of team. When people come together, they can achieve goals that they couldn’t achieve alone. You see it in business. You see it in sports. It’s about achieving specific goals, but it’s also about developing people to the next level. Being a part of that process brings me true satisfaction.

Sometimes, it’s easier to be an individual contributor and know all the things you need to perform than to get a whole team to do it. But there is opportunity in taking on the challenge of team building. It combines my passion and skills and gives me a sense of purpose.

I give you the last word.

When you follow this plan early on, you stay on schedule. If you’re already in a hole, the focus is not why did you get here. It’s how do you move forward and get back on schedule. There is no situation that can’t be resolved. Typically, it takes 3-5 years to clear major hurdles and change your trajectory quite a bit. The time is going to pass one way or another.