I’ve spent the last odd week glued to my phone. Keeping current on stock charts, r/wallstreetbets, Twitter, CNBC, and text chains with family and friends was a full-time occupation. I’ve been following the markets for years, and never have I been more riveted on what was going on. And never have I witnessed a market event garner this much attention from a diverse collection of personalities, ranging from politicians AOC, Ro Khanna, and Ted Cruz, to talking heads Chris Cuomo, Trevor Noah, and Tucker Carlson, to investing types Dave Portnoy, Mark Cuban, and Chamath. One thing is for certain and no matter what happens next week: the game of investing will never be the same again.

I’m not going to explain here what a short squeeze is and how the rapid surge in $GME (GameStop stock ticker) triggered what may be the greatest short squeeze of all time. (A simple Google search has you covered). Nor am I going to explain how the rapid surge in other tickers like $AMC (movie theater), $NOK (Nokia), and $BB (BlackBerry) had a similar effect that prompted hedgefunds like Citadel and Melvin Capital to cover shorts and eat billions of dollars in losses, and was likely behind a 1,000 point dip in the S&P 500.

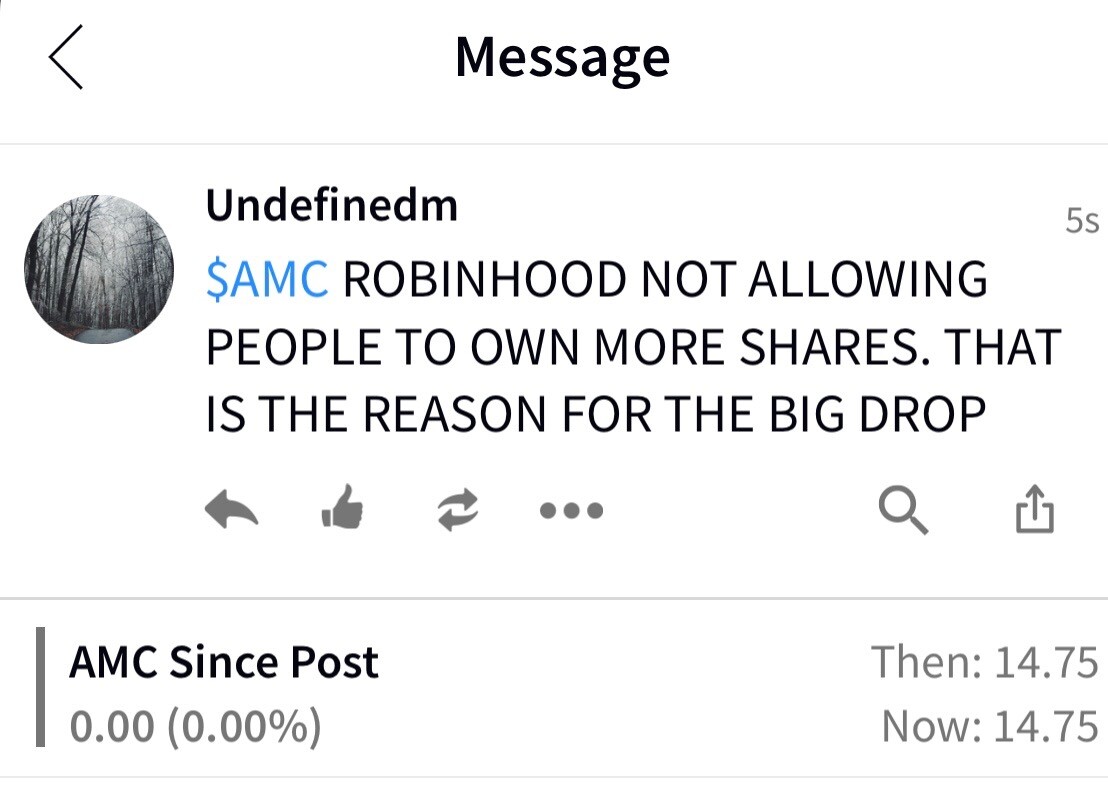

Had Robinhood CEO, Vladimir Tenev, and company not unexpectedly (and, to my mind, unfairly and unjustifiably) halted buying of these stocks on Thursday, January 28th, and limited the amount of shares that could be bought on Friday, January 29th, the effect would have been even more pronounced. Robinhood effectively crashed (temporarily) the price of these stocks, costing their retail customers millions of dollars and enabling billionaire hedgefunds like Citadel, with whom they also do business, to exit positions at a more favorable price point. The irony of the name Robinhood has not been lost on anyone. Whether the brokerage ever recovers, class action lawsuits aside, from what many of its users interpret as an epic scandal, and “the worst business decision of all time,” remains to be seen.

It’s very clear that @RobinhoodAPP and Hedge Funds like Citadel are saying we’ll take our chances with class action lawsuits and white collar crimes and paying people off to stay out of prison rather than their firms going bankrupt #DDTG. . . The thing that drives myself and so many people nuts is this belief that when this is over guys like Ken Griffin from Citadel Gabriel Plotkin from Melvin, Steve Cohen, and Vlad will be at some secret country club laughing at all of us. And deep down we know we are right. #DDTG.

Dave Portnoy, Founder of Barstool sports, who owns stock in nokia and amc. this week he became a voice for retail investors through his many viral tweets and media appearances.

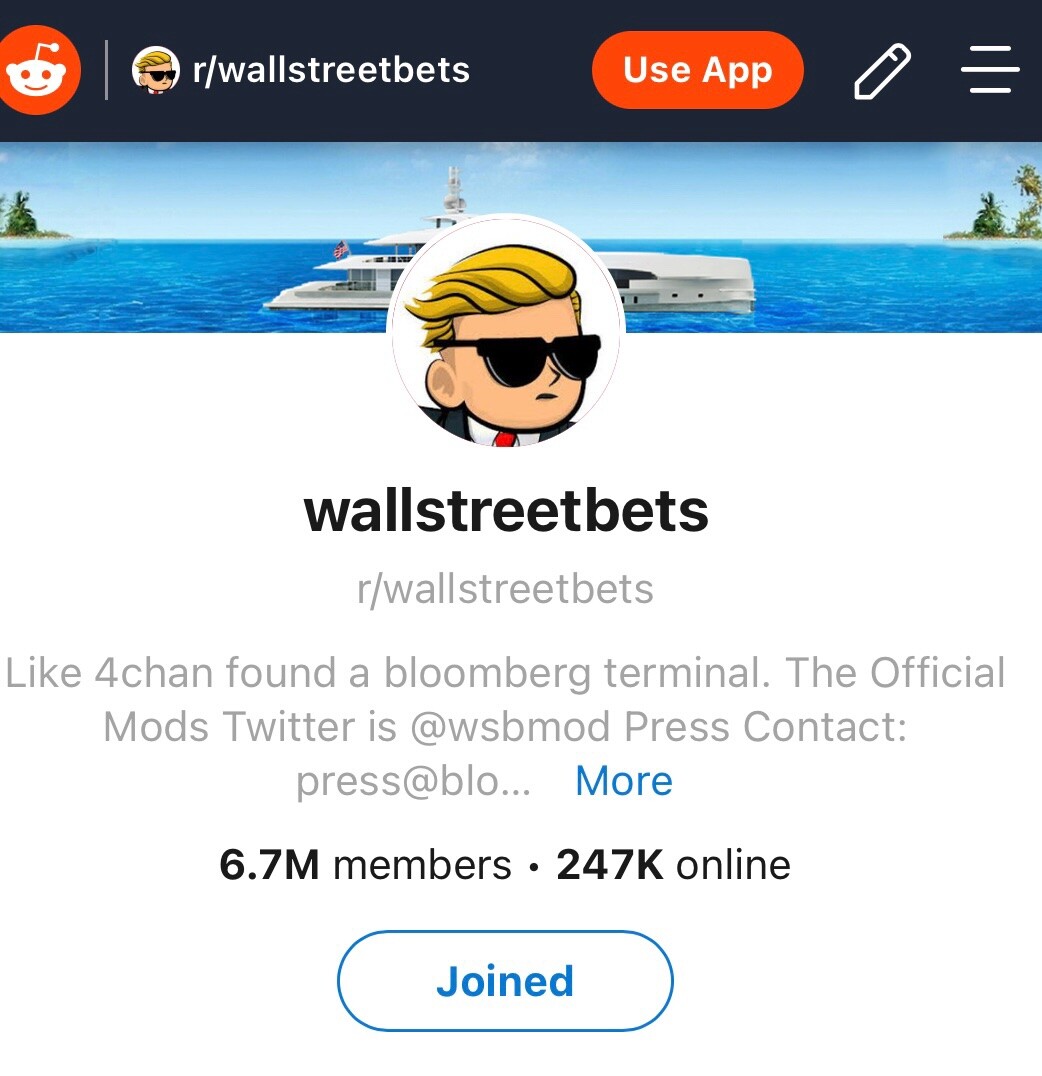

The short squeezes took a coordinated effort, organized primarily on Reddit’s r/ wallstreetbets forum, on the part of tens of thousands of small cap retail investors. While many people were first introduced to the forum this week, which now boasts of millions of subscribers, the reality is Reddit had been planning the squeeze for months in a bid to save GameStop and make Wall Street pay for its greedy, dubious short-selling practices (link). This week marked the first time retail investors managed to radically drive market momentum in an event that is likely to trigger permanent changes in the way hedgefunds and institutions invest their money, and engender new SEC regulations governing markets.

I got to say I LOVE LOVE what is going on with #wallstreetbets. All of those years of High Frequency Traders front running retail traders, now speed and density of information and retail trading is giving the little guy an edge. Even my 11 yr old traded w them and made $. . . Why does Wall Street have such an advantage over the little guy? The SEC. SEC doesn’t follow laws. They have legal precedents. Which means they can sue you knowing you have no financial ability to fight back. As can Wall St. SEC protects no one but the jobs of their own lawyers. . . They [the SEC] could be very clear about what is allowed and what isn’t but they won’t. Why ? Because their entire workforce is built on lawyers who want to Litigate to Regulate. They don’t want clear delineation. They want to sue. They want to intimidate.

Shark Mark Cuban, owner of the dallas mavericks, adding his two cents to the theme this week on twitter.

Top-down enforcement of rules against naked shorting and other leveraged instruments (e.g. effectively capping short interest somewhere below 100%), and voluntary portfolio hedging measures are a likely outcome of this debacle. Billionaire Mark Cuban, for example, said on CNBC this week that he “hedged the hec out of [his] portfolio” to protect himself against unpredictable momentum moves like this in the future. All wise investors will follow suit, and short investors will think long and hard before placing their bets in the future. It is the end of an era, and the beginning of a new, less predictable one with multiple centers of power and less institutional domination.

Facebook and @RobinhoodApp are the same: They both trick you into thinking you are the customer. But, in fact, you are the product and your data is the asset. These assets are then sold to their true customers who pay them money and always at your expense. STOP BEING TRICKED! . . . All the money in 2008 was made by suits identifying a market dislocation and exploiting it. All the money in 2021 was made by retail identifying a market dislocation and exploiting it. . . until the suits intervened. . .In moments of uncertainty, when courage and strength are required, you find out who the true corporatist scumbags are.

Chamath Palihapitiya, CEO of Social Capital, who published these viral tweets and became a spokesman for retail investors.

The GameStop saga is so fascinating because it features the intersection of multiple sociopolitical and cultural dynamics. There’s traditional Wall Street / institutional investors versus Main Street / retail investors (IE “big money” versus “small money”). Or “class warfare” framed in more conventional, adversarial terms. There’s also the rise of the internet and online communities as a catalyst for social change. This second dynamic was epitomized by the numbers of r/wallstreetbets users and cooperatives who loyally held their holdings in $GME and $AMC, and added to their positions, all the while mainstream powers were doing everything in their power to create selling pressure.

Take the home run. Don’t go for the grand slam. Take the home run. You’ve already won. You’ve won the game.

Jim Cramer, on CNBC’s “squawk on the street” the morning of 1.29.2021.

“Diamond hand or bust” became the mantra, in a testament to the resolve of many retail investors to ignore the advice of Jim Cramer and company (the high-energy host of Mad Money, who is widely considered an ally of ordinary investors) by holding at all costs, and refusing to take profits or panic sell. Documentaries, theses, PhDs, TV shows, criminal investigations, dramatic anecdotes, and countless articles like this one will spring from this. The GameStop Saga is one of the most significant market events to ever transpire and a fascinating legacy of the Covid-19 pandemic, which saw massive growth in retail investing and online communities.

Motivation on r/wallstreetbets ranged from punishing Wall Street and “sticking it to the man” for exploiting the public for decades, community solidarity, and simply making $. While next week will dictate whether it was a grand slam or simply a homerun, one thing is for sure: the Redditors and the retail investors won. And they won by a landslide.

What is your biggest takeaway from the events that transpired this week?

[…] a source of connection with others. (Remember when wallstreetbets investors and nostalgic gamers sent the stock of GameStop skyrocketing.) Recently in the US, the spread of vaccines and an increase in herd immunity has led more and more […]